==================================================

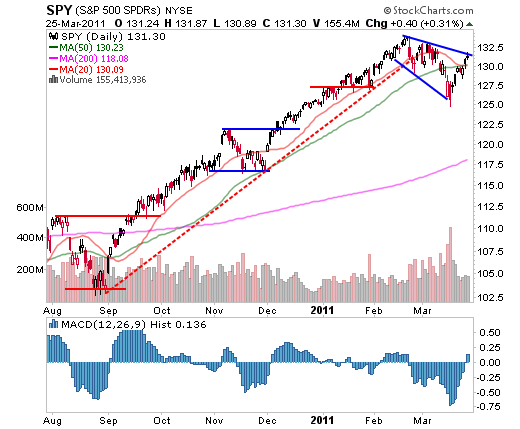

The S&P 500, as represented by the S&P 500 SPDRS (NYSE:SPY), has rallied by more than 10 points from its March lows, and in very short order. Many traders expected the $130 level to reject SPY, but after a brief pause, it continued its march higher. In fact, the bounce is eerily similar to the one that occurred in September, where traders who weren’t quick to react were left behind. SPY is currently testing the top of a broadening wedge that has been forming and could find some resistance in this area. Traders should carefully monitor how SPY behaves in the coming days to see if this pattern can be cleared. An ideal scenario for bulls would be for SPY to trade in a tight range just above $130 as it builds some energy for a sustained breakout.

|

| Source: StockCharts.com The Bottom Line What a difference a week makes. Last week, the markets started to show some life but the expected outcome was for the bounce to run its course and the markets to retest the lows. While I wouldn’t necessarily rule this scenario out, the markets did accomplish some good things this week and the technical picture has changed substantially. The lows formed in March are now very key levels to watch. Due to the strength of this bounce, the markets should not even sniff these levels if this bounce will turn into a significant rally. Last week we mentioned that V bottoms are rare; one reason for this is that participants who bought the lows are now sitting on handsome profits. With the market's currently testing resistance, it will be interesting to see if current longs will be anxious to book some profits. Chasing after a two-week rally will likely be punished, so once again, patience needs to be stressed to anyone watching from the sidelines. Despite the recent strength, the technical picture remains neutral at best. The markets are still under key resistance levels and likely need some time before a true breakout. ============================================== |

Εβδομαδιαία Ανασκόπηση για 4- 8 Απριλίου του 2011

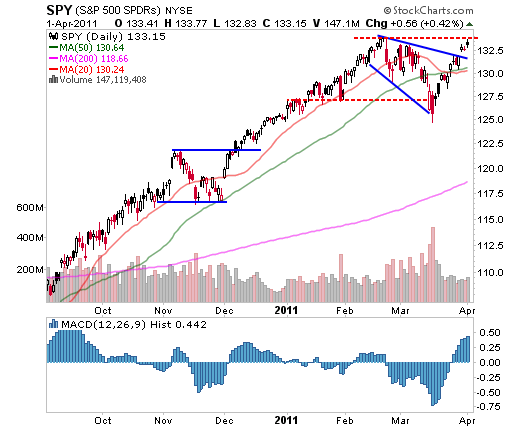

Ο SP500 ο οποίος αντιπροσωπεύεται από το δείκτη SP500 SPDRS(NYSE: SPY) είναι ένας από τους 2 μεγάλους δείκτες που προηγουμένως αναφερθήκαμε που όπως θα δείτε στο επισυναπτόμενο διάγραμμα παρόλο τη μεγάλη αναπήδηση που είδαμε παραμένει σημαντικά πιο κάτω από μια σημαντική Αντίσταση. Σε κάθε περίπτωση ουδείς μπορει να αμφισβητήσει τη παρούσα δυναμική της κίνησης όπως αυτή προκύπτει. Καποιοι δείκτες είναι ήδη υπεραγορασμένοι, βλέπε McLean Oscillator, και οποιαδήποτε ανοδική διάσπαση μπορεί να τεθεί υπό αμφισβήτηση με αυξημένες πιθανότητες αντιστροφής.

Οι ενεργοί παίκτες πρέπει να παρακολουθούν για τον SPY τα σημεία αντίστασης 134-135 και μια υποχώρηση στα σημεία όπου βρίσκεται ο κινητός μέσος των 20 ημερών και των 50 ημερών αντίστοιχα δεν θα αποτελέσει έκπληξη.

Kαλή Εβδομάδα σε όλους!!!!!!!!!!

=====================================================

The Weekly Report For April 18th - April 22nd, 2011

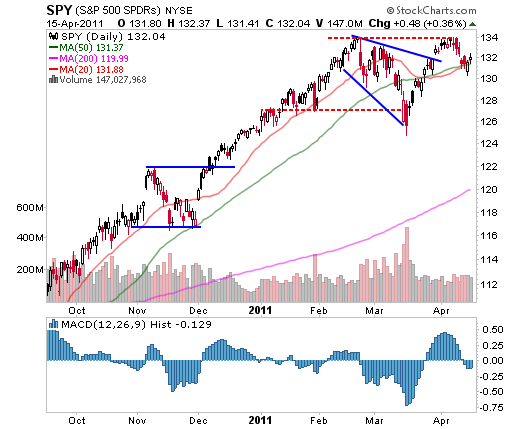

The S&P 500, as represented by the S&P 500 SPDRS (NYSE:SPY), briefly dipped under its 20- and 50-day moving averages this week, but managed to close the week back above these levels. The lows set this week are important to monitor as they may be the key to whether the recent pullback is merely at its midway point or, worse, is just getting started. Now that buyers have defended this area, the markets will likely attempt to breach the $134 level again and much will depend on what happens then. If the markets reverse back under this week’s lows, they could be headed back to test the lows set in March.

|

| Source: StockCharts.com |

=============================================

The main story on Monday was that Standard & Poors kept US government bond ratings at AAA, but cut its outlook from stable to negative. This sent stocks tumbling out of the gate to as low as Dow 12,093 before bouncing over a hundred points. Yet even that finish was still well into the red.

Personally I am shocked and dismayed by this reaction. Why? How could anyone think that our debt situation was actually in good shape?. In fact, how is it still AAA and not lower?. I assumed, falsely I now see, that everyone with an IQ above room temperature was working off the same premise that our deficit was raging out of control. And that, my friends, provides a valuable investing lesson. Don't assume anything. Because as they say, when you "assume" you end up making an "ass" out of "u" and "me" ;-)

My strong hope and desire is that this truly lights a fire under our politicians to take make aggressive deficit cuts soon. If not, then our debt ratings will drop while interest rates go higher. This will make financing the debt all the more difficult and wreak havoc on the economy. If we can show resolve to reign in our bad ways now, then this economic recovery can stay on track with stocks moving higher.

=====================================

Ομπάμα: Κοινός στόχος η μείωση του ελλείμματος

Ο Αμερικανός πρόεδρος Μπαράκ Ομπάμα τράβηξε σήμερα μια διαχωριστική γραμμή μεταξύ των σχεδίων που έχουν παρουσιάσει οι Δημοκρατικοί και οι Ρεπουμπλικάνοι για τον περιορισμό του δημοσιονομικού ελλείμματος, ωστόσο δήλωσε ότι υπάρχει η θέληση για την επίτευξη συμφωνίας παρά τις ιδεολογικές διαφορές, όπως μεταδίδει το Reuters.

Και τα δύο κόμματα έχουν συμφωνήσει ότι χρειάζεται να επιτευχθούν περικοπές δαπανών ύψους άνω των 4 τρισ. δολ. σε διάστημα δέκα ετών, δήλωσε ο πρόεδρος των ΗΠΑ μιλώντας σε εκδήλωση σήμερα στη Βιρτζίνια. Ωστόσο, πρόσθεσε, διαφωνούν στα περιεχόμενο των περικοπών προκειμένου να φτάσουμε στον στόχο.

Ο Ομπάμα δεν έδωσε καμία ένδειξη για το ενδεχόμενο μεγαλύτερης ευελιξίας στο σχέδιο του για την αύξηση των φορολογικών συντελεστών στους πιο πλούσιους Αμερικανούς και διατήρηση των επενδύσεων στην εκπαίδευση και τις υποδομές.

Πηγή:www.capital.gr

=============================================

The Weekly Report For April 25th - April 29th, 2011

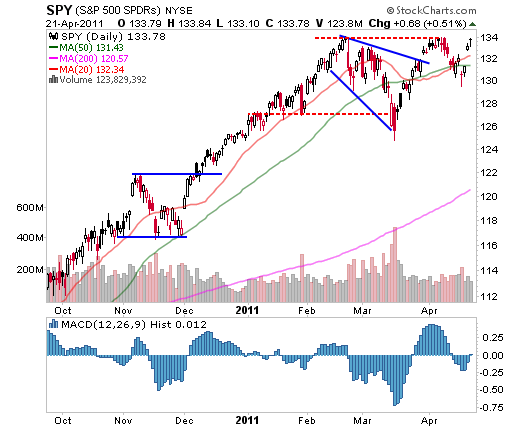

The S&P 500, as represented by the S&P 500 SPDRS (NYSE:SPY), had a very sharp reversal gap on Wednesday and is now back near the very important resistance level of $134. Thus, technically speaking, SPY is not out of the woods yet. However, this week’s strength surely has some bears on edge, and any dip into the unfilled gap near $132 should bring in buyers who missed this week's turn. The lows near $130 are now very important levels to watch for swing traders.

| ||

| Source: StockCharts.com ==================================================================

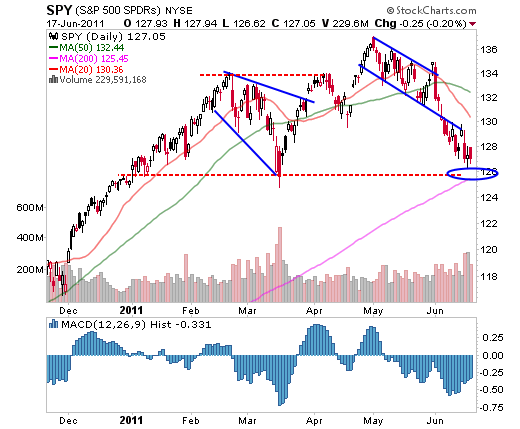

The Weekly Report For June 13th - June 17th, 2011

Commentary: Despite a few attempts at a bounce, the markets ended the week lower once again, making it seven straight weeks down. Last we week we noted that “The majority of the week was spent moving lower, with any attempts at strength being quickly rebuffed” and this week followed the same pattern. The markets are certainly oversold and a bounce may be imminent, but that doesn’t mean traders should become aggressive. The first bounce attempt is likely to be faded rather quickly, and only the most aggressive traders (or very long term value investors) should even bother trying to time this market.

While the S&P500 as represented by the S&P 500 SPDRS (NYSE:SPY) appears to be trying to find support already, the March lows and 200-day moving average near $126 may act as a magnet in the near term. Often these important levels draw prices to them as a form of self fulfilled prophecy. This means SPY could drop some more before any bounce materializes. In fact, it could experience a flush below this level forcing traders to capitulate. While this is all speculation, the point is that traders should not get too comfortable playing for an oversold bounce. While likely, it could force a trader to endure more pain than they expect.

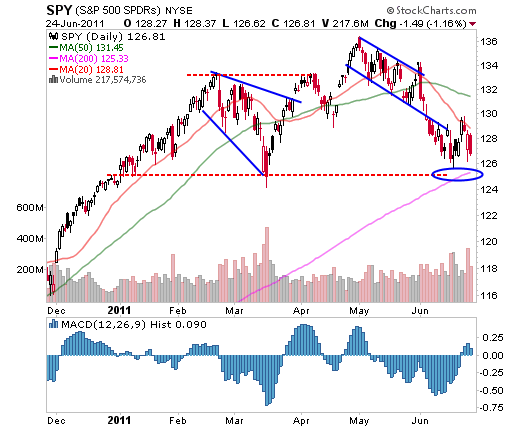

The Weekly Report For June 27th - July 1st, 2011

Commentary: It was a volatile week as the markets attempted to halt their recent declines. The markets have still been unable to string along consecutive positive days; there were some signs of hope this week for longs. While Tuesday’s gap higher was completely erased on Wednesday, the markets shook off a breakdown attempt on Thursday and managed to show some strength on a reversal. Unfortunately, Friday was also another down day and in the end, the markets closed near their lows for the week. However, bulls have been gradually turning the trend sideways, and despite the negative week, the indexes held above last weeks lows. Overall, the markets are oversold and sentiment has been turning bearish. We mentioned last week that “the first bounce attempt is likely to be faded rather quickly” and this is indeed what occurred. However, if the market indexes can hold off the selling and attempt another bounce, it could carry further, and maybe test the markets declining 50-day moving averages.

The S&P 500 as represented by the S&P 500 SPDRS (NYSE:SPY) actually managed to stay above its Thursday low, despite the weak close on Friday. It also held above last weeks low’s which was positive. While the trend is still clearly lower, the markets are already oversold as they test an important support level near $126. Much like it’s difficult for the markets to break out in a straight line higher; it is unlikely for the markets to continue sliding lower without a bounce. With volume also picking up at these levels, it appears that buyers are starting to step in. However, if the 2008 Bear market taught us anything, it’s that the market can always get more oversold. Traders need to keep an eye on the $126 level and see how SPY continues to ACT near this level.

|

Δεν υπάρχουν σχόλια:

Δεν επιτρέπονται νέα σχόλια.